How do universities worldwide expand academic ties, develop new research approaches, and tap into emerging ideas? One of the best ways to achieve these goals is to attract a talented and diverse group of recent PhD graduates for post-doctoral positions, which have long been considered as powerful engines for growth.

The main purpose of a post-doc is to develop the professional and academic skills of new PhDs, while providing them a “home” under the mentorship of an experienced researcher. The skills, experience and networking ties the young researchers gain at this stage can be key in helping them secure tenure-track faculty positions in the future. At the same time, the innovative ideas the researchers develop and pursue, and the academic ties they provide, position the hosting institution ahead of the curve in academic progress.

Recognizing the importance of supporting post-doc researchers’ foundations and private donors have created fellowship programs offering sponsored positions in various disciplines and creating a pool of talented young scientists and thinkers at the world’s top universities.

Tapping into the Expertise Network

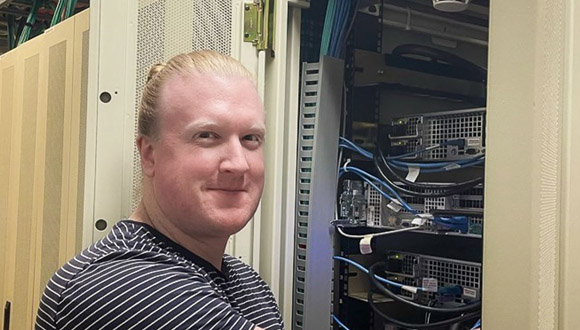

Dr. Joshua Barrow is a post-doc scholar supported by the binational US-Israel Zuckerman STEM Leadership Program. He holds a joint appointment at Tel Aviv University and the Massachusetts Institute of Technology, working at the intersection of nuclear and particle physics research.

Dr. Joshua Barrow hooking up cables for a new experiment at the MicroBooNE data acquisition subsystem

“In the field of particle physics specifically, collaborative work proves absolutely necessary. The experiments we build to study the most fundamental properties of matter—our colliders, accelerators, and detectors—are gigantic machines that require a team effort deep with cooperative knowledge. We bounce ideas off a lot of people and expertise is distributed throughout our large networks,” he says.

“Meeting other like-minded people allows us to fast-track the development of ideas and cross-pollinate them across disciplines.” – Dr. Joshua Barrow

Originally from Tennessee, Barrow “caught the research bug” in college, when he decided that physics was the optimal discipline that combined “philosophy, logic, and the ultimate question of how things work in the universe.” He works with Prof. Or Hen at MIT and with Dr. Adi Ashkenazi at Tel Aviv University’s Raymond & Beverly Sackler School of Physics and Astronomy. “These professors were interested in working together. I aligned with both of their research interests and provided a bridge between principal investigators in both countries,” he explains.

Barrow, who started his Zuckerman Fellowship in the fall of 2021, met the 2021 cohort of Zuckerman Scholars in Israel from other fields and universities. “Meeting other like-minded people allows us to fast-track the development of ideas and cross-pollinate them across disciplines,” he muses.

Barrow, who hopes to continue working at national laboratories or as a university professor, plans to continue collaborations with TAU into the future, wherever he lands professionally. “The problems we’re trying to solve at TAU are interesting, and the undergraduate students are very bright.”

Discovering the Local Perspective

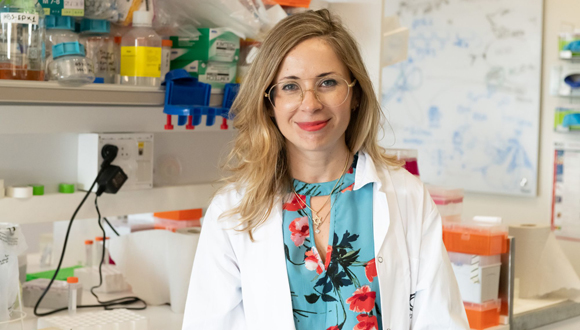

Post-doctoral exchange is no less vital in social science than in hard sciences. Dr. Lior Birger [featured on the article’s main image] is a Bloomfield post-doc researcher at Tel Aviv University’s Bob Shapell School of Social Work. She researches best practices in working with displaced populations, refugees, and asylum seekers. As part of her PhD research, Birger conducted fieldwork in Germany, where she initiated contact with the Alice Salomon University (ASH) School of Social Work in Berlin. Thanks to this connection and the support from the German-Israeli Future Forum, Birger and her colleague at the Bob Shapell School, Dr. Nora Korin-Langer later created two joint courses in migration between ASH and TAU.

“The post-doc is a critical phase for all scholars, but for women, especially. Women and mothers face more intense challenges that require additional flexibility and compromises.” Dr. Lior Birger

“Our students, both graduate, and undergrads, Jews and Arabs, get to learn about forced migration and meet displaced populations on the ground in both countries, which helps broaden their horizons and grasp the problem as a global issue, while providing different perspectives on the challenges of social exclusion and marginalization,” Birger says. The courses include a two-day preparation in Tel Aviv and then a week in Berlin.

In September 2022, Birger started another post-doc position in Sussex, UK. “The post-doc is a critical phase for all scholars, but for women, especially. Women and mothers face more intense challenges that require additional flexibility and compromises,” she says. “Programs providing post-doc fellowships alleviate some of the financial burdens on young researchers and allow them to develop independently – providing flexibility and much-needed support at this challenging stage,” she concludes.

Nurturing Ties

Prof. Ralf Metzler, the current Chair for Theoretical Physics at the University of Potsdam, Germany, arrived in Israel in 1998 for his post-doc at Tel Aviv University after connecting with TAU chemistry professor Joseph Klafter after a seminar.

“Post-doc positions prevent you from steaming in your own juice. The best post-docs are the ones where you get really different perspectives, both in science and society,” he says.

“The best post-docs are the ones where you get really different perspectives, both in science and society.” Prof. Ralf Metzler

Metzler spent two and a half years at TAU, where he met some of his “best friends in science,” and he continues his collaboration with Israeli scientists today, and even hopes to come back to Israel to work sometime.

“I’ve become an advocate for Israel—I love the place,” he says. Metzler transfers his admiration of Israel to his students, many of whom come from countries such as China and Iran. “I hope that they go back changed, in a way,” he concludes.

Prof. Ralf Metzler (left) and Prof. Joseph Klafter

Moving Forward

Boosting the number of post-doctoral positions on campus has been one of Tel Aviv University’s organizational priorities. The number of post-doc fellows at TAU has risen 25% over the last five years to 477 fellows in 2022.

“In contrast to science in the US and Europe, Israeli science traditionally relied on Ph.D. students and not on post-docs,” explains Prof. Yossi Yovel, the head of TAU’s Sagol School of Neuroscience and senior lecturer at The George S. Wise Faculty of Life Sciences, who is always on the lookout for strong post-docs.

“In the past few years, however, we are observing a change in this pattern with more and more Israeli and international candidates looking to do their post-doc fellowship in Israel. The value and contribution of a strong post-doc can be instrumental in propelling progress at TAU, and in Israel, in general,” he adds.

Source: TAU Review

%20Prof.%20Yair%20Bar-Haim%20Gal%20Arad%20%26%20Omer%20Azriel_580.jpg)